Jeff Bezos visit

to India was overshadowed by few related political incidences. One was

ostensible refusal by both Prime Minister Modi and Commerce Minister Piyush

Goyal to meet him. Secondly, there was a statement on Amazon attributed to

Goyal. Apparently, Goyal had hinted Amazon was not doing any favour by

investing in India and instead the investment was in their own self-interest.

It might be a different matter that the statement was twisted as usual by the

media over-eager to hit back at the government. Yet, for all the outwardly

deceptiveness of protection of small grocers, at the heart of the kerfuffle, was the

seemingly biased reporting by Bezos owned Washington Post in recent times on

India. An analysis of the same can be found in the piece ‘

WaPo

and White Man’s Burden’.

Government

industry relations have always been one of jigsaw puzzles. To the industry,

government would be the forum where they would love to shop for protecting

their domestic markets from foreign entrants and secondly seeking protection to

their legacy business models from the disruptive business models. The industry often fancies itself as arbiter

of regulation given the professed expertize in their domain. Implied is they

anticipate government to consult them when framing policies for new business

entities. Incidentally, emergence of a disruptive phenomenon makes the

bureaucrats seek advice of the known experts who happen to be the existent

firms, more often than likely victims of the disruption. Indubitably, the

process is underpinned on an apparent conflict of interest given their characteristic

concern of legacy protection and continuation.

Corporates use

government apparatus in furtherance of their interests overseas. Conflicting

interests between national government and overseas firms backed by their

governments recurrently degenerated into coups, counter-coups, agitations,

civil wars, colonialism etc. President Arbenz of Guatemala nationalised the

banana plantations owned by United Fruit Company that were creating social and

economic havoc. At UFC’s insistence, CIA backed a coup in1954 deposing Arbenz

and installed a puppet to serve the bidding of UFC. Nationalising oil companies

in Iran made Britain and CIA jointly oust PM Mossadegh in a coup and reinstate Shah.

Recently, Evo Morales of Bolivia argued his ouster was a reaction to his attempts

to nationalize lithium reserves that did not serve the US interests. European

powers constantly intervened in African colonies to serve their economic

interests so did the US in countries like Philippines, Haiti, Chile among other

countries.

Washington

Consensus is derided by critics of being camouflage for advancing US economic

interests. The introduction of TRIPS in Uruguay Round of trade negotiations and

consequent adoption were perceived to be an outcome of entrenched

pharmaceutical lobby in the US seeking market access to emergent countries. Widespread

perception abounds on global trade rules being recrafted to suit the economic

agenda of US corporate backed by its government than genuine aspiration to

reform the global trade in easing the barriers of mobility in trade, capital,

technology and labour.

Huawei in

seeking to monopolize 5G networks globally is, for good reason, viewed as an instrument

of Chinese imperialist ambitions. The hostile reaction therefore is a societal

response to the Chinese drives. China has sought to advance its objectives to

set infra projects like ports in Sri Lanka, Myanmar, Djibouti, railroads in

Kenya among other ways. Chinese firms more often than not, are essentially

party run irrespective of what they claim to be. The party control is concealed

beneath the series of veils. Huawei’s veil is slowly being pierced. To China,

perhaps a learning curve of 19th century imperialism is leading it

on a policy what few have described as incremental imperialism. However the

Chinese debt games have a precedent albeit in a different form in Latin

American countries. India seems to be very late comer in the games and its

moves if any are highly tentative.

Similarly,

within the country, the contestations for supremacy between corporate and

government has been for many years. In the US, led by dominant industrialists

and financers like Rockefeller, Morgan among others, monopolies were erected in

virtually every sector including steel, oil etc. Presidential administrations

often overlooked these encroachments despite presence of legislative framework

like Sherman Act. However, President Theodore Roosevelt believed the state was

supreme and the firms had to submit to state supremacy. In series of

trust-busting actions, monopolies were unravelled.

In India, the

nationalization of banks of 1969 was essentially believed to hit at the

corporates whom PM Indira Gandhi believed to be working against her interests.

Nationalization in the garb of eliminating concentration of wealth in the hands

of few served good politics despite the long run consequences in terms of

economic despair. Land reforms like Tenancy elimination etc. were essentially

again targeting certain zamindari coalitions that perhaps might have been a

threat to those in power. The cat and

mouse game goes on in many countries in different manifestations at different

points of time. Yet it would be of interest to understand how the games play

out.

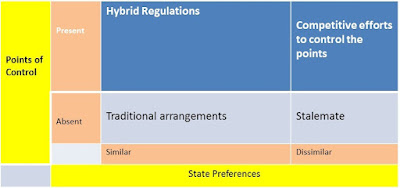

Henry Farrell, presented a matrix, illustrated

below that captures the state-private actor dynamics. The objective is to

illustrate the formulation than debate the pros and cons of the formulation.

Source:Henry Farrell, Governing Information Flows, State and Private Actors, - this diagram is representative illustration of the matrix

To Farrell, the crescendos

revolve around two parameters, the preferences of the state and the points of

control available to the state. As the globalization increases in intensity

accompanied by equally strong backlash, numerous challenges emerge. The states

with decreasing control over cross border flow of information and resources

need to redefine their strategic priorities. Many an occasion, different states

might manifest differing preferences, the outcome of which would be an

inability to arrive at global consensus. Online gambling might be illegal in some

countries, yet many small countries would be open to the idea given the revenue

potential. Traditional arrangements work best when states

as a whole exhibit congruence and no points of control exist. The international

agreements arise when such consensus is possible. To many states, in the absence

of points of control, the capacity to exert its power is limited and thus

willing to compromise. If the points of control are present, and the state

bargaining power is strong, hybrid regulations emerge. Most of these might even

in more ways than one benefit the private actors while getting state support.

The US administration towards the end of the 19th century

demonstrated the hybrid arrangements best. Currently the role of ICANN best demonstrates

the same.

Contradicting

preferences between states and private actors often result in stalemate in the

absence of points of control. This stalemate however is contingent of the state

capacity. In the absence of state capacity to act, the stalemate might give way

to private domination. Very few global arrangements are possible and each state

might reveal power relative to its state capacity. In the presence of points of control, there is

without doubt competitive attempts to wrest their control. Moreover, the willingness

and credibility of the state to exercise its power in leveraging points of

control determine the trajectory of these contestations. The firms desire

regulatory capture at state’s expense resulting in contradictory impulses.

These battles often get played out in overseas political geographies in a

different manner and an altogether different game is played in the native

geography. US often went after the corporate power to rein in monopoly power

and promote competition. There was competitive battle for the same, yet the

corporate and state cooperated in exerting power in terms of capture of

sovereignty overseas directly or indirectly. Chinese attempts in overseas regulatory

capture as well as its application of power domestically on MNCs illustrate the

gradation of exercise of power owing to the increasing state capacity.

Amazon-India

cold war is a manifestation of century old battles and India is well within its

right to exercise its sovereignty. There are points of control and state

capacity is perchance stronger than ever before and thus high times establishes

its interests and sensitivities and acts upon the same. Domestic interests are paramount and there cannot

be compromise on the same. India’s stand on RCEP is a reflection of the same.

India has to prove its state capacity as also the alacrity and credibility in

leveraging the points of control to its benefit when it comes to protection of

national interests.

Comments

Post a Comment