Intellectual Property Differentials Across Industries

- Get link

- X

- Other Apps

The

debate on intellectual property rights (IPRs) at the global level seems to rest

primarily on a single size fits all model. The US driven agenda to enforce

stricter norms for IP across countries is ostensibly an attempt to push the US

agenda. Now that the incoming US administration led by President Biden is

likely to revive TPP, it is possible that IP issues might come to the fore yet

again. However, while examining the empirical realities, the IP practices vary

from industry to industry. Rarely there exists an industry which has an uniform

IP practice relative to other industries. It must beg to be explained why the

differentials in IP exists across industries.

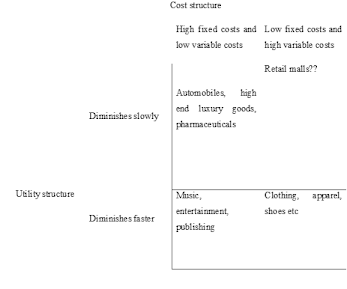

In

an earlier paper, one had discussed at certain length on how IP differentials

could be linked to interplay between costs and utility. In economics, firms

strive for profit maximization while consumers seek maximization of utility. The

interplay between the two can be analysed through an examination of the firm’s

cost structure as against the utility derivation from the consumers. Firms with

high costs but price elastic might demonstrate different perspectives as

against firms with low fixed costs. As one examines the costs, higher fixed

costs signify the essence of economies of scale. Consumer utility maximization is premised on

the existence of income constraints and the presence of diminishing marginal

utility. The following table posits the juxtaposition of the two factors.

IPRs and Industries-

Utility Cost Analysis

|

| Add caption |

Source: Prashant Kulkarni, Towards Locating Market

Failure as an Outcome of Intellectual Property Regime: Mapping the IPR-Market-Society Interfaces

(2013)

When

one examines the above matrix and looks at the evidence from the field, an

interesting patterns emerge. Those industries which tend to have high variable

costs are relatively lax in enforcing certain types of IPRs. For instance,

fashion and accessories industries emphasize on trade-marks and are not so obsessed

with the patents or copyrights. Derivative reworking of fashion designs is not

uncommon. In fact, there is a tacit encouragement towards the same despite some

public protestations. Apparently, the presence of knock-offs do not affect the

industry revenues as evident from their reactions in contrast let us say to the

entertainment industry. This perhaps has to do not just with nature of costs

but with the nature of consumer utility that exists in the industry. The fashion

trends fade off fast. The marginal utility seems to diminish and the differentiation

element wears off fast. Technological interventions are not possible. The only

differentiator is the brand and therefore they are obsessed with brands and

trade-marks and not with copyrights. The firms know their users seek the brand

and the associated signals it indicates, an indicator of Veblen good. Therefore,

their emphasis on the trademarks and not copyrights. They perhaps would not

mind seeking induced obsolescence thus allowance for fresh designs each year.

Yet

as one examines the entertainment industry, it seems the other way round. They do

experience a short product cycle accompanied by faster diminishing utilities. They

too need fresh investment each season. Piracy levels are similar to those

present in the fashion industry. Yet the response to piracy by the

entertainment industry is completely in contrast to the fashion industry. While

at one level, the fashion industry seems oblivious to the phenomenon of piracy,

entertainment industry in particular seems to take Broken Windows model very

seriously and goes after the smallest of the violators. The answers perhaps lie

in the cost structure. The cost structure in the entertainment industry is

strongly geared towards the fixed costs. The industry exhibits high degree of

instantiation. It is an industry that can be digitalized cent per cent in

contrast to the fashion industry which is physical. Replication costs in the

entertainment industry are close to zero. Branding while being an important

differentiator is not the sole determinant. The availability of substitutes and

the people’s motivations to try out entertainment goods differ considerably. Therefore,

the industry demonstrates its attitudes towards the pirates very differently

and thus obsessed with copyrights.

In

the pharmaceutical industry, Broken Windows does make them go hard after the alleged

violators but often find themselves struggling against national sovereignty the

very reason they came up with global patent regime in the Uruguay round of

international trade negotiations. While they have high fixed costs, the

availability of substitutes do not exist in a similar manner like the

entertainment industry. They too exhibit instantiation properties yet, the

marginal utility remains relatively higher for considerable period of time. The

product cycles are not short. They have high fixed costs and marginal utility

does not diminish fast. This perhaps explains why they seek patents which confer

a monopoly for a longer period. They seek to control on the flow of duplicates

if one might have to call it.

The

high variable costs and low diminishing marginal utility perhaps does not have

too many examples and they perhaps are not relevant in the debate on IP. In the

matrix illustrated above, there is no doubt presence of industries that do not

fit in the above explanations. Automobile industry does experience a high fixed

cost accompanied by lower levels of marginal utility but perhaps what changes

the dimension is the reproduction costs. It is not easy to replicate a car as

opposed to let us say pharmaceutical drugs or movies or music. Therefore,

economies of scale is essential for reproduction too thus these costs might

come in the way of their application of IP rules and the consequent enforcement

of the same. Furthermore, they might be subject to holdouts in their build up

to the launch of the vehicle and thus might get reflected in their own attitude

towards IP enforcement. Each industry has it own set of motivations towards

enforcement of IPRs. The current post seeks to build on the past research and

try and seek explanation what could account for those differentials. This is perhaps

the beginning of the research discussion and questions being framed. It needs

to be built up and expanded to account for other factors too.

- Get link

- X

- Other Apps

Comments

Post a Comment